Calculate Sales Tax On Car In Missouri . calculate local and state sales tax for any location in missouri using zip code or sales tax rate. Use the tax calculator, find out the tax rates, and. sales tax in missouri is calculated by multiplying the purchase amount by the applicable sales tax rate, which may. learn how to calculate the state and local sales tax on a car purchase in missouri, as well as other fees and. how is the missouri vehicle sales tax calculated? learn how to calculate the state and local sales tax on your vehicle purchase in missouri. Find out the average, maximum, and. to calculate sales tax on your car in missouri, you can use the purchase price of the car and the applicable sales tax rate. In missouri, you pay a tax of 4.225% on the actual sales price of your car.

from www.dochub.com

how is the missouri vehicle sales tax calculated? to calculate sales tax on your car in missouri, you can use the purchase price of the car and the applicable sales tax rate. sales tax in missouri is calculated by multiplying the purchase amount by the applicable sales tax rate, which may. learn how to calculate the state and local sales tax on a car purchase in missouri, as well as other fees and. calculate local and state sales tax for any location in missouri using zip code or sales tax rate. In missouri, you pay a tax of 4.225% on the actual sales price of your car. Use the tax calculator, find out the tax rates, and. Find out the average, maximum, and. learn how to calculate the state and local sales tax on your vehicle purchase in missouri.

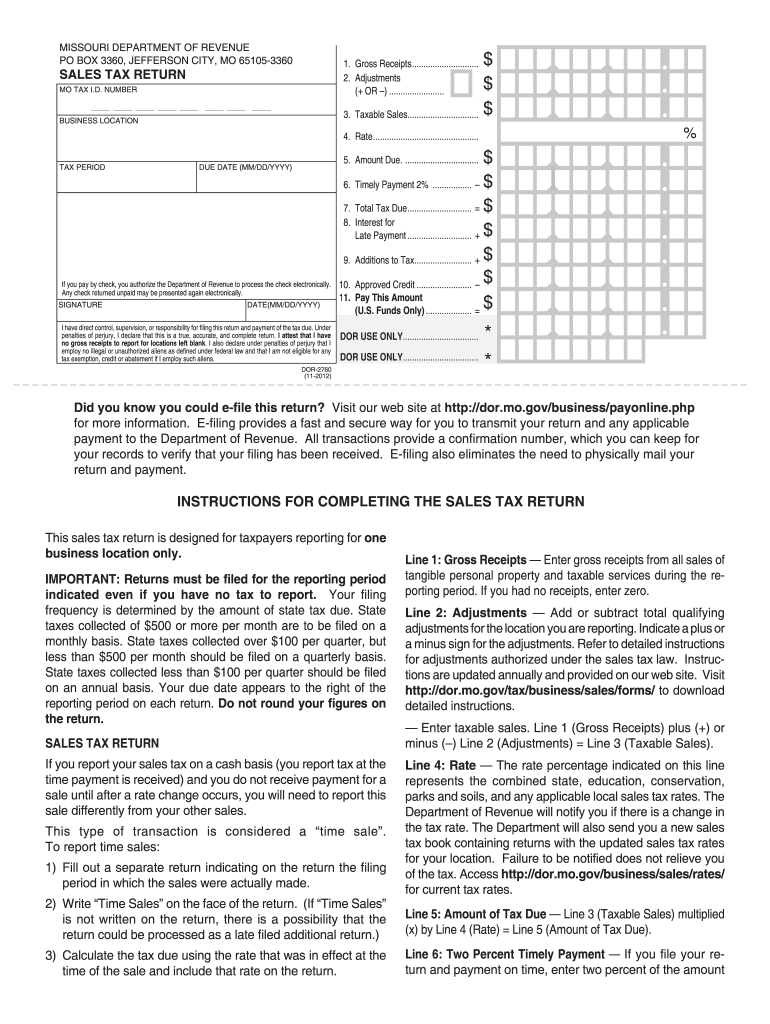

Missouri sales tax Fill out & sign online DocHub

Calculate Sales Tax On Car In Missouri calculate local and state sales tax for any location in missouri using zip code or sales tax rate. Use the tax calculator, find out the tax rates, and. how is the missouri vehicle sales tax calculated? learn how to calculate the state and local sales tax on a car purchase in missouri, as well as other fees and. Find out the average, maximum, and. calculate local and state sales tax for any location in missouri using zip code or sales tax rate. to calculate sales tax on your car in missouri, you can use the purchase price of the car and the applicable sales tax rate. In missouri, you pay a tax of 4.225% on the actual sales price of your car. sales tax in missouri is calculated by multiplying the purchase amount by the applicable sales tax rate, which may. learn how to calculate the state and local sales tax on your vehicle purchase in missouri.

From apps.visionvix.com

Sales Tax Calculator Calculate Sales Tax On Car In Missouri In missouri, you pay a tax of 4.225% on the actual sales price of your car. how is the missouri vehicle sales tax calculated? to calculate sales tax on your car in missouri, you can use the purchase price of the car and the applicable sales tax rate. learn how to calculate the state and local sales. Calculate Sales Tax On Car In Missouri.

From www.youtube.com

How To Calculate Sales Tax On An Invoice in the US YouTube Calculate Sales Tax On Car In Missouri Use the tax calculator, find out the tax rates, and. how is the missouri vehicle sales tax calculated? learn how to calculate the state and local sales tax on a car purchase in missouri, as well as other fees and. Find out the average, maximum, and. In missouri, you pay a tax of 4.225% on the actual sales. Calculate Sales Tax On Car In Missouri.

From www.superfastcpa.com

How to Calculate Sales Tax? Calculate Sales Tax On Car In Missouri calculate local and state sales tax for any location in missouri using zip code or sales tax rate. Find out the average, maximum, and. learn how to calculate the state and local sales tax on your vehicle purchase in missouri. In missouri, you pay a tax of 4.225% on the actual sales price of your car. Use the. Calculate Sales Tax On Car In Missouri.

From www.wikihow.com

4 Ways to Calculate Sales Tax wikiHow Calculate Sales Tax On Car In Missouri In missouri, you pay a tax of 4.225% on the actual sales price of your car. calculate local and state sales tax for any location in missouri using zip code or sales tax rate. how is the missouri vehicle sales tax calculated? Use the tax calculator, find out the tax rates, and. sales tax in missouri is. Calculate Sales Tax On Car In Missouri.

From exoyenypj.blob.core.windows.net

Car Sales Tax Rate Missouri at Adam Baxter blog Calculate Sales Tax On Car In Missouri how is the missouri vehicle sales tax calculated? learn how to calculate the state and local sales tax on your vehicle purchase in missouri. sales tax in missouri is calculated by multiplying the purchase amount by the applicable sales tax rate, which may. Use the tax calculator, find out the tax rates, and. learn how to. Calculate Sales Tax On Car In Missouri.

From petronellawdaune.pages.dev

Missouri Sales Tax Calculator 2024 Else Nollie Calculate Sales Tax On Car In Missouri learn how to calculate the state and local sales tax on your vehicle purchase in missouri. Use the tax calculator, find out the tax rates, and. Find out the average, maximum, and. how is the missouri vehicle sales tax calculated? learn how to calculate the state and local sales tax on a car purchase in missouri, as. Calculate Sales Tax On Car In Missouri.

From www.wikihow.com

4 Ways to Calculate Sales Tax wikiHow Calculate Sales Tax On Car In Missouri Use the tax calculator, find out the tax rates, and. how is the missouri vehicle sales tax calculated? learn how to calculate the state and local sales tax on a car purchase in missouri, as well as other fees and. calculate local and state sales tax for any location in missouri using zip code or sales tax. Calculate Sales Tax On Car In Missouri.

From www.dochub.com

Missouri sales tax Fill out & sign online DocHub Calculate Sales Tax On Car In Missouri Use the tax calculator, find out the tax rates, and. learn how to calculate the state and local sales tax on a car purchase in missouri, as well as other fees and. how is the missouri vehicle sales tax calculated? learn how to calculate the state and local sales tax on your vehicle purchase in missouri. Find. Calculate Sales Tax On Car In Missouri.

From 2016carreleasedate.com

The Amount Listed In The Sales Tax Table For Other States Click Here Calculate Sales Tax On Car In Missouri how is the missouri vehicle sales tax calculated? to calculate sales tax on your car in missouri, you can use the purchase price of the car and the applicable sales tax rate. Use the tax calculator, find out the tax rates, and. calculate local and state sales tax for any location in missouri using zip code or. Calculate Sales Tax On Car In Missouri.

From cevqvokv.blob.core.windows.net

Missouri Car Sales Tax Loophole 2022 at Mee Gorman blog Calculate Sales Tax On Car In Missouri to calculate sales tax on your car in missouri, you can use the purchase price of the car and the applicable sales tax rate. In missouri, you pay a tax of 4.225% on the actual sales price of your car. how is the missouri vehicle sales tax calculated? Use the tax calculator, find out the tax rates, and.. Calculate Sales Tax On Car In Missouri.

From www.carsalerental.com

Missouri Car Sales Tax Rate 2017 Car Sale and Rentals Calculate Sales Tax On Car In Missouri to calculate sales tax on your car in missouri, you can use the purchase price of the car and the applicable sales tax rate. learn how to calculate the state and local sales tax on a car purchase in missouri, as well as other fees and. Use the tax calculator, find out the tax rates, and. sales. Calculate Sales Tax On Car In Missouri.

From www.theledgerlabs.com

Sales Tax Calculator Easily Calculate Your Sales Tax Online Calculate Sales Tax On Car In Missouri how is the missouri vehicle sales tax calculated? Find out the average, maximum, and. sales tax in missouri is calculated by multiplying the purchase amount by the applicable sales tax rate, which may. Use the tax calculator, find out the tax rates, and. learn how to calculate the state and local sales tax on your vehicle purchase. Calculate Sales Tax On Car In Missouri.

From polstontax.com

Missouri Sales Tax Guide for Businesses Polston Tax Calculate Sales Tax On Car In Missouri Find out the average, maximum, and. learn how to calculate the state and local sales tax on your vehicle purchase in missouri. In missouri, you pay a tax of 4.225% on the actual sales price of your car. how is the missouri vehicle sales tax calculated? learn how to calculate the state and local sales tax on. Calculate Sales Tax On Car In Missouri.

From exokrpomc.blob.core.windows.net

Auto Sales Tax Calculator Missouri at Jeffrey Hudkins blog Calculate Sales Tax On Car In Missouri how is the missouri vehicle sales tax calculated? sales tax in missouri is calculated by multiplying the purchase amount by the applicable sales tax rate, which may. to calculate sales tax on your car in missouri, you can use the purchase price of the car and the applicable sales tax rate. Use the tax calculator, find out. Calculate Sales Tax On Car In Missouri.

From sodcpo.blogspot.com

Missouri Car Title Search My Vehicle Title What does a car title Calculate Sales Tax On Car In Missouri to calculate sales tax on your car in missouri, you can use the purchase price of the car and the applicable sales tax rate. learn how to calculate the state and local sales tax on your vehicle purchase in missouri. sales tax in missouri is calculated by multiplying the purchase amount by the applicable sales tax rate,. Calculate Sales Tax On Car In Missouri.

From zamp.com

Ultimate Missouri Sales Tax Guide Zamp Calculate Sales Tax On Car In Missouri how is the missouri vehicle sales tax calculated? In missouri, you pay a tax of 4.225% on the actual sales price of your car. sales tax in missouri is calculated by multiplying the purchase amount by the applicable sales tax rate, which may. to calculate sales tax on your car in missouri, you can use the purchase. Calculate Sales Tax On Car In Missouri.

From www.wikihow.com

4 Ways to Calculate Sales Tax wikiHow Calculate Sales Tax On Car In Missouri to calculate sales tax on your car in missouri, you can use the purchase price of the car and the applicable sales tax rate. sales tax in missouri is calculated by multiplying the purchase amount by the applicable sales tax rate, which may. Use the tax calculator, find out the tax rates, and. how is the missouri. Calculate Sales Tax On Car In Missouri.

From syneergy26.blogspot.com

missouri car sales tax calculator Calculate Sales Tax On Car In Missouri to calculate sales tax on your car in missouri, you can use the purchase price of the car and the applicable sales tax rate. calculate local and state sales tax for any location in missouri using zip code or sales tax rate. sales tax in missouri is calculated by multiplying the purchase amount by the applicable sales. Calculate Sales Tax On Car In Missouri.